E Invoice Malaysia

What is E Invoice Malaysia

E-invoices are digital documents that replace paper or electronic invoices, credit notes, and debit notes in Malaysia. They contain the same essential information as traditional documents, such as supplier and buyer details, item description, quantity, price excluding tax, tax, and total amount. By implementing E Invoice Malaysia, businesses can efficiently record transaction data for daily operations.

Digitalise tax and financial reporting

Aligns financial reporting and processes to be digitalised with industry standards for micro, small and medium-sized enterprises

Reduce Manual Efforts and Human Errors

Unite your invoicing process by electronically creating and submitting transaction documents to reduce manual efforts and human errors.

Seamless System Integration for Efficient Tax Reporting

Connect your financial systems to streamline your tax reporting process and ensure accurate and timely compliance.

Optimize Your Invoicing Process with Digital Documents

Save money and time by electronically creating and submitting E-invoices in Malaysia. E-Invoices streamline your invoicing process and reduce manual errors.

How does E Invoice Malaysia work?

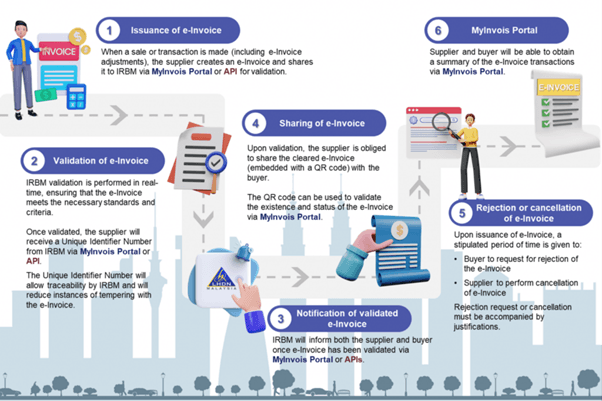

Refer to the IRBM E-Invoice guideline version 1.0, from the moment a sale is made or a transaction occurs, the E Invoice Malaysia workflow facilitates seamless sending and receiving electronic invoicing between suppliers and buyers. The process begins with the supplier issuing an E-Invoice through the MyInvois Portal or API. This E-Invoice Malaysia is then validated real time and stored securely in IRBM’s database. Buyers can easily access their historical E-Invoice through the MyInvois Portal, ensuring transparent and efficient financial recordkeeping.

Who are required to implement E Invoice Malaysia?

E-Invoicing will be mandatory for all business owners based on their turnover or revenue thresholds, and will be implemented in phases. The roll-out of E Invoice Malaysia has been planned with careful consideration, considering the turnover or revenue thresholds, providing businesses with sufficient time to adapt.

Companies need to take proactive steps to ready themselves for the forthcoming E-Invoicing requirement by evaluating their existing IT systems, ERP system, and tax compliance procedures to guarantee alignment with the updated standards. While the Budget proposal extends the preparation period for taxpayers, the delay is not substantial enough in practical terms.

Below is the E Invoice Malaysia implementation timeline as per the latest announcement by LHDN.

|

Targeted Taxpayers |

Implementation Date |

|

Taxpayers with an annual turnover or revenue of more than RM25 million and up to RM100 million |

1 January 2025 |

|

Taxpayers with an annual turnover or revenue of more than RM5 million and up to RM25 million |

1 July 2025 |

|

Taxpayers with an annual turnover or revenue of more than RM1 million and up to RM5 million |

1 January 2026 |

|

Taxpayers with an annual turnover or revenue of more than RM500,000 up to RM1,000,000 |

1 July 2026 |

|

Note: e-Invoice implementation timeline been updated on 6 June 2025 |

|

Overview of the E-Invoice Model

To facilitate transition to E Invoice Malaysia, taxpayers can select the most suitable mechanism to transmit E-Invoices to IRBM, based on their business requirements and specific situation.

There are two (2) options for the E-Invoice transmission mechanisms for taxpayer’s selection:

- MyInvois Portal

- A portal hosted by IRBM

- Accessible to all taxpayers at no cost

- Also accessible to taxpayers who need to issue e-Invoice where Application Programming Interface (API) connection is unavailable

- Application Programming Interface (API)

- An API is a set of programming code that enables direct data transmission between the taxpayers’ system and MyInvois system

- Requires upfront investment in technology and adjustments to taxpayers existing systems

Ideal for large taxpayers or businesses with substantial transaction volumes

What is TIN Number?

In Malaysia, a TIN, or Tax Identification Number, is officially known as ‘Nombor Pengenalan Cukai.’ It is a unique identifier assigned to individuals and entities registered with the Inland Revenue Board of Malaysia (IRBM) as taxpayers. The purpose of the TIN is to distinguish taxpayers, maintain tax records, and facilitate tax compliance monitoring and anti-evasion measures.

The Inland Revenue Board of Malaysia (LHDN) recently introduced an updated TIN format, effective from January 1, 2023. Under the previous format, TINs were 12 or 13-digit numbers, with the initial letter(s) indicating the taxpayer type (e.g., ‘SG’ for individual residents or ‘C’ for companies). The remaining digits served as a unique identifier.

Under the new format, all TINs will start with ‘IG,’ signifying ‘Individual taxpayer.’ The following 11 digits will remain the same as in the old TIN. To check your TIN online or get more details about this new format, visit the LHDN website.

72 hours grace period for Buyer / Seller for cancellation and Rejection

Rejection and cancellation workflow

A significant highlight of these changes of E-Invoice regulation, based on the E Invoice Malaysia guideline version 2.1 release by LHDN, is the introduction of a 72-hour grace period. This grace period empowers businesses to make necessary adjustments to their E-Invoices within 72 hours of the initial invoice issuance. It serves as a valuable opportunity to rectify any errors or discrepancies on the invoice. Understanding how this grace period operates and when to use debit notes and credit notes is vital for businesses operating in Malaysia to ensure accurate and compliant invoicing practices.

Here’s a more detailed breakdown of the 72-hour E-Invoicing grace period

Businesses have the option to reject or request the cancellation of an E-Invoice within 72 hours from its issuance.

Once this 72-hour window elapses, further modifications to the E-Invoice are not permitted.

If changes are necessary after the grace period, businesses must issue a new invoice, debit note, credit note, or refund.

It’s crucial to maintain meticulous records of these adjustments and adhere to the relevant regulations to ensure compliance with the guidelines set by the Inland Revenue Board (IRB).

Buyer-Requested Rejection:

Within the first 72 hours of receiving an E-Invoice, the buyer can initiate a request for its rejection.

The seller will receive a notification when the buyer requests rejection.

The seller’s approval is required for the buyer’s rejection request to be accepted, resulting in the cancellation of the E-Invoice.

If the seller does not approve the buyer’s request within the 72 hours, the E-Invoice will automatically be considered valid.

Seller-Initiated Cancellation:

Sellers also have the option to initiate the cancellation of an E-Invoice within 72 hours.

If the seller cancels the E-Invoice, the buyer is relieved of the obligation to make the payment specified on the invoice.

Beyond the 72-hour mark, the E-Invoice will be automatically deemed valid.

Any subsequent modifications to the E-Invoice will require to issue a debit or credit note.”

Why chooses Our Software?

It is important to prepare in advance for the upcoming E-Invoicing system in Malaysia, as invoicing will be mandatory to be implemented by July 2025, to all business owners in Malaysia. This is why you should be considering our Synergy Software to be your software provider.

Synergy Software provide a user-friendly and secure solution for E-Invoicing Malaysia that seamlessly integrates with your existing processes such as invoicing framework. From compliance to customization and cost savings, we’ve got you covered. Join us to simplify your financial workflows, invoice solutions, increase efficiency, and stay ahead in the world of modern invoicing

Synergy Accounting System

Synergy Software provide accounting software for small businesses built in mind of user-friendliness, performance, security and scalability.

POS System (Point Of Sales)

Point of Sale System by Synergy Software is a comprehensive and user-friendly solution designed for businesses to efficiently manage their point-of-sale operations.

What We Offer

POS System & Accounting Software

Our team of dedicated professionals is passionate about helping businesses improve their operating efficiency and achieve success.

FAQ

Frequently Asked Questions (FAQ)

E-Invoicing, or electronic invoicing, refers to the digital exchange of invoices between businesses. Instead of paper-based invoices, E-Invoices are created, sent, received, and processed electronically.

E-Invoice Malaysia offers several advantages:

– Efficiency: Faster invoice processing, reduced manual work, and streamlined communication.

– Cost Savings: Lower printing, postage, and administrative costs.

– Accuracy: Reduced errors due to manual data entry.

– Compliance: Alignment with global invoicing standards.

Yes, E-Invoices are legally recognized in Malaysia. The government encourages their adoption to enhance efficiency and reduce paperwork.

An E-Invoice Malaysia typically includes:

Business details (sender and recipient)

Invoice number

Date of issue

Itemized goods/services

Total amount

Tax details (if applicable)

E-Invoice Malaysia platforms prioritize data security. Encryption, authentication, and secure channels are used to protect sensitive information.

Choose a reliable E-Invoicing solution.

Train staff on the new process.

Test the system thoroughly.

An E-Invoice Malaysia, also known as an electronic invoice, differs from a normal invoice in Malaysia primarily in its format and delivery method. While a normal invoice is typically a physical document printed on paper and sent via mail, an E-Invoice is generated, transmitted, and stored electronically.

E-invoices in Malaysia are recognized by the government and are part of initiatives to promote digitalization in business transactions. It replaces paper or other electronic documents such as invoices, credit notes, and debit notes or an invoice in non-specified format (such as image, PDF, and Excel)

Normal Invoice:

- Traditional paper document or electronic file (PDF, Excel)

- Format varies – less standardized

- Manual processing, prone to errors

E–Invoice:

- Digital file in a specific format mandated by the Inland Revenue Board of Malaysia (IRBM) – typically XML or JSON

- Contains 53 mandatory fields for details like seller information, buyer information, product details, and taxes

- Designed for automated processing by accounting systems, leading to faster and more accurate transactions

In Malaysia, the mandatory threshold for E-Invoicing (E-Invoice Malaysia) depends on your business’s annual turnover:

Effective from 1st August 2024: RM100 million (MYR 100 million) or more. Businesses exceeding this threshold must issue E-Invoices for B2B transactions.

From 1st January 2025: The threshold reduces to RM25 million (MYR 25 million) and above. Businesses exceeding this new limit will also be required to switch to E-Invoicing for B2B transactions.

By 1st July 2025: E-Invoicing becomes mandatory for all taxpayers in Malaysia, regardless of their annual turnover.

Companies can choose any of the following transmission modes to report E-Invoices:

MyInvois Portal hosted by IRBM: Accessible to all businesses, suitable for a small volume of data, feasible for Micro, Small, and Medium-sized Enterprises (MSMEs).

Application Programming Interface (API): Requires investment in technology and modifications to current systems. Ideal for large businesses with a huge volume of transactions, available in XML or JSON format.

Types of E-Invoice in Malaysia:

Type of E-Invoice Malaysia

Invoice: A commercial document itemizing and recording a transaction between a supplier and a buyer.

Credit Note: Issued by a seller to acknowledge that the buyer is owed a refund or credit, used for product returns, billing errors, or adjustments in the original invoice.

Refund Note: Issued by a seller to acknowledge the repayment of money for a previous purchase.

Debit Note: Sent by a seller to inform the buyer of an increase in the amount they owe, often issued for additional charges, corrections, or adjustments to a previous transaction.

E-Invoices (E-Invoice Malaysia) serve several crucial purposes in the Malaysian business landscape:

- Enhanced Efficiency and Automation: E-Invoice Malaysia replaces traditional paper invoices with a standardized digital format (XML or JSON). This allows for seamless integration with accounting software, automating data entry and streamlining workflows. Say goodbye to manual processes and hello to faster transaction cycles.

- Reduced Errors and Improved Accuracy: Manual data entry on traditional invoices is error-prone. E-Invoice Malaysia eliminates this risk by enabling automatic data transfer between systems. This ensures accuracy and consistency in your financial records.

- Simplified Record-Keeping: E-Invoices are stored electronically, providing a secure and easily accessible digital record of your transactions. No more struggling with mountains of paper. You can effortlessly retrieve past invoices whenever needed.

- Compliance with Upcoming Regulations: The Malaysian government is mandating E-Invoicing (E-Invoice Malaysia) for all businesses in stages. By familiarizing yourself with the system now, you’ll be well-prepared to comply with upcoming regulations and avoid any penalties.

- Environmental Sustainability: E-Invoice Malaysia eliminates the need for paper invoices, reducing your business’s environmental footprint. This can be a significant advantage for companies looking to promote eco-friendly practices.

In essence, E-Invoice Malaysia is a win-win for businesses. It enhances efficiency, reduces errors, simplifies record-keeping, ensures compliance, and promotes sustainability. As Malaysia transitions towards a digital invoicing system, embracing E-Invoice Malaysia is a smart move for any business looking to operate efficiently and responsibly.